A formal financial education system should be established in Romania, introducing financial education in the eighth grade, said Marian Siminică, Executive Director of ISF (Institute of Financial Studies), during the ZF Bankers Summit 2022 Conference.

“We are talking about introducing financial education in the eighth grade, and results will already be visible in the near future. There are also discussions about introducing financial education elements in primary education for grades 3-8. We have two financial education programs for teachers who teach eighth grade, and the results are already visible. We quantify the results obtained through these programs. At the ISF and IBR level, we have trained over 1,000 teachers in less than a year. If we multiply this by at least two classes of students they will teach, we have a direct impact on 50-100 students per teacher.”

What else Marian Siminică said at ZF Bankers 2022:

- We are in the process of accrediting a financial education program for primary school teachers.

- A financial education program for high schools is next. There, we will target student classes with representatives from financial markets to talk to students about current issues.

- We have financial programs in universities. We currently have 20 partner universities in Romania, most with an economic profile, but we are also pushing toward universities with technical or non-economic profiles.

- Trust can be gained through education. When a person gains confidence in a product, understands how it works, its advantages, and associated risks, then it becomes interesting to access it.

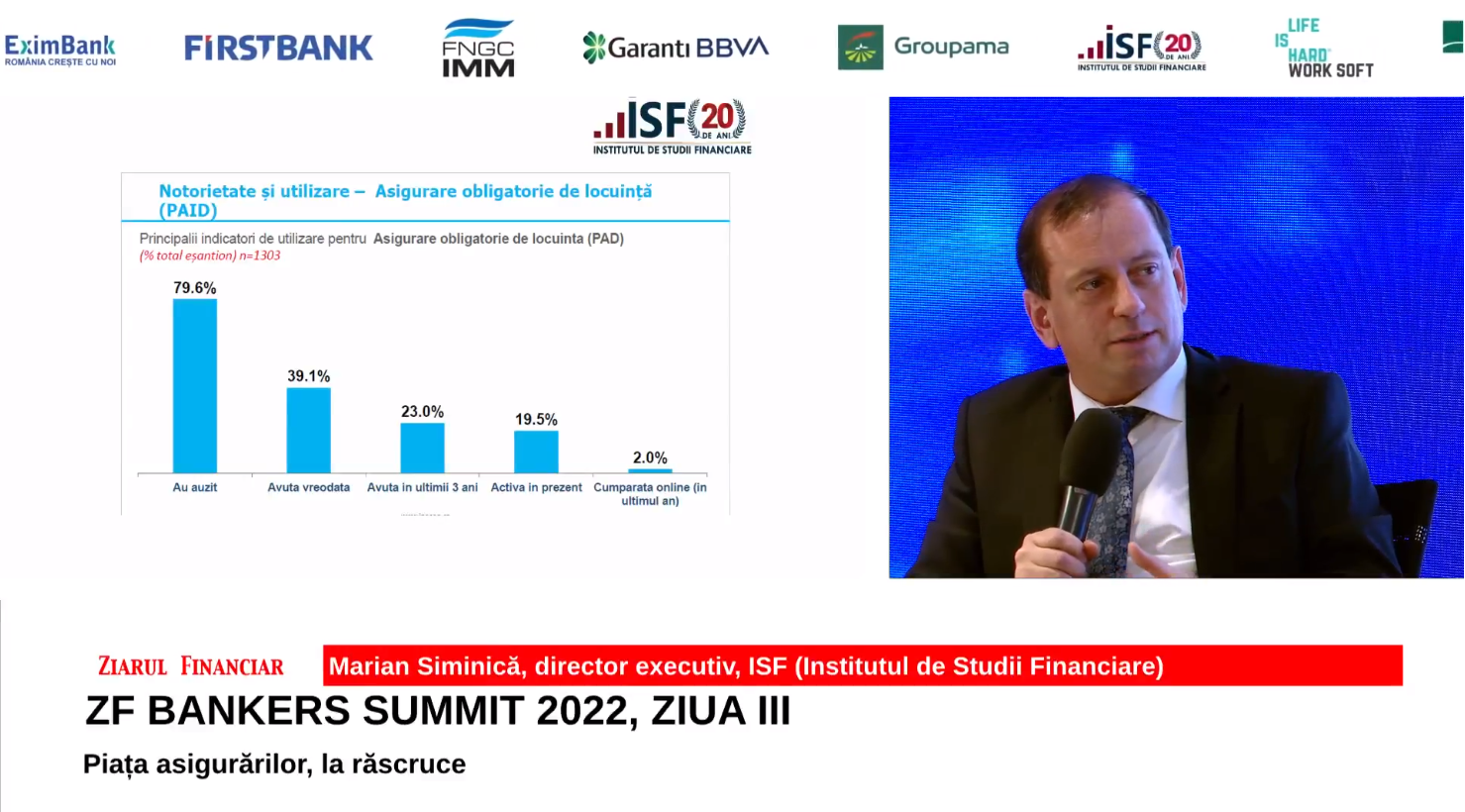

- When we calibrate our financial education projects, we look at the deficiencies identified based on studies like those from the OECD, but we also have our own research. This spring, we conducted a survey, a questionnaire regarding the perception of consumers of non-banking financial services, insurance, private pensions, and the capital market. There are interesting data showing the knowledge of financial service users and how much they apply for a certain type of financial product. For example, regarding third-party liability insurance, the well-known RCA, 83.4% of respondents are aware of the product’s existence. Health insurance is also known but less accessed.

- There are also clear methodologies for quantifying the level of financial education, and the most relevant is the study conducted by the OECD, which launches such a study approximately every five years. The latest results were published in 2020, based on a questionnaire conducted in several countries. The last study was carried out in 26 countries worldwide, including Romania, and a questionnaire was applied to a representative sample of the population. In Romania, the sample consisted of 1,060 people, and the level of financial education was directly measured through questions asked of the respondents. The questions covered three categories: knowledge, categories, and behaviors, and based on the respondents’ answers, the level of financial education was assessed through a composite indicator in each country where the study was conducted. Unfortunately, Romania did not achieve a very good score, 11.2 points out of a maximum of 21 points, representing a compliance rate of 51%. Hong Kong ranks first, followed by Slovenia and another European country.

Sursa here